Easy Steps of setup or formation of a private limited company in Bangladesh. How to form a company and the Company Registration process and registration in Bangladesh, the cost of a limited company and the post-registration process have been focused on in this article.

This article has focused on an easy way of starting a business by forming a limited company, name clearance and registration cost, and registration legal compliance issues i.e. TIN, VAT, and Trade License for foreign and Bangladeshi nationals and entities.

This article will guide the formation of a private limited company in Bangladesh and its Tax Compliances. There are various ways to start a business in Bangladesh and one of the most preferred options and useful modes is to incorporate a Private Limited Company.

Therefore, this article will focus on the procedure of registering a private limited company in Bangladesh. In addition, the legal compliances such as Tax compliance of a private limited company in Bangladesh after incorporation will also be reflected in this article. Company Formation Process in Bangladesh 2024

This comprehensive guide outlines the step-by-step process for forming a Private Limited Company in Bangladesh. It covers crucial aspects such as name clearance, drafting MOA and AOA, opening a bank account, sharing money deposits, registration with the Registrar of Joint Stock Companies (RJSC), required documents, government costs, and obtaining the incorporation certificate.

The post-registration procedures, including obtaining a Tax Identification Number (TIN), Trade License, and filing annual returns with RJSC, are also detailed. Additionally, the importance of VAT registration and the role of corporate lawyers, exemplified by CLP in Bangladesh, are highlighted for legal compliance and expert guidance in the business setup process.

Contents

- 1 Ways of Company Formation Process in Bangladesh

- 2 Registration to RJSC:

- 3 Required documents and information for company formation in Bangladesh

- 4 Government cost for Company registration in Bangladesh:

- 5 Company Tax Identification Number (TIN):

- 6 Company Trade license

- 7 Legal Advice regarding setting up a private limited company in Bangladesh by CLP

Ways of Company Formation Process in Bangladesh

There are five ways of doing business in Bangladesh. They are as follows:

- Private Limited Company

- Public Limited company

- Branch office

- Liaison Office

- Proprietorship

Why a private limited company is a popular way of doing business?

It is comparatively easier and less costly compared to public limited companies. In addition, a private limited company is a full-fledged way to generate income compared to a branch office and liaison office. Furthermore, a proprietorship will not create a legal entity that a private limited company does create.

Steps to the formation of a private limited company in Bangladesh

Name clearance

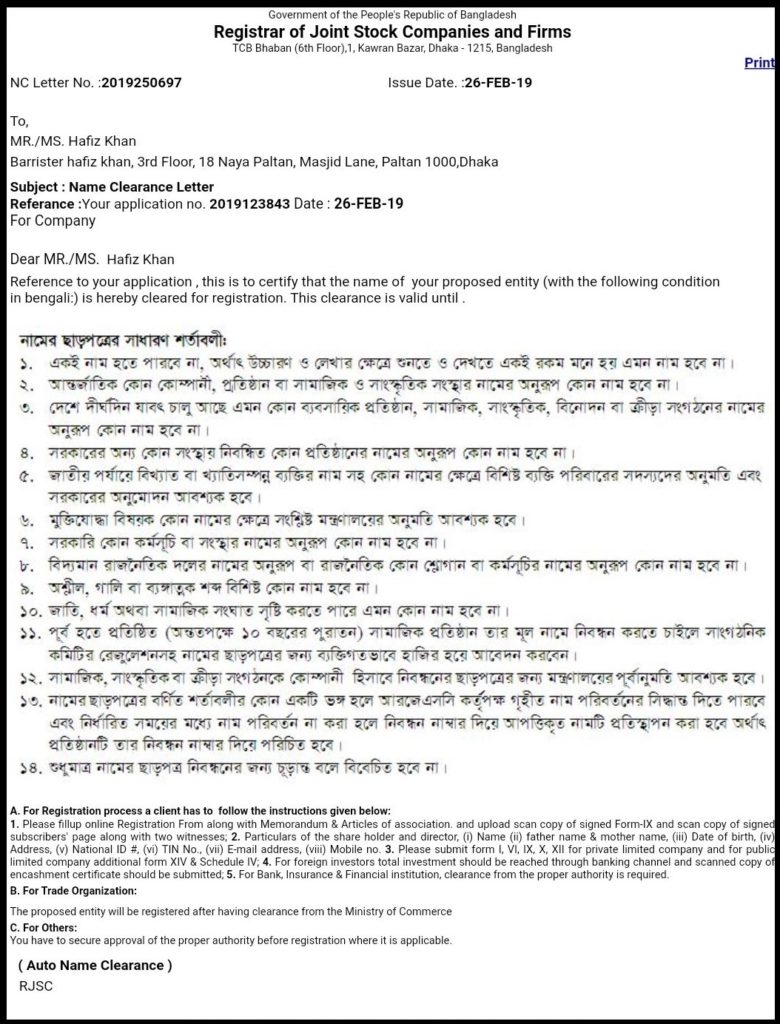

To form a private limited company, the first step is to choose a name for the company which should be unique. After choosing the name, one needs to apply for name clearance to get the name approval certificate from the Registrar of Joint Stock Companies and Firms (RJSC). It usually takes 1 to 2 days to get the certificate. Currently, the government fee for name clearance is 230 BDT or 3 USD. It should be noted that there are some differences in terms of forming a limited company in Bangladesh between Bangladeshi nationals and foreign nationals/entities. you can apply for name clearance here.

Below is a sample name clearance Certificate

Drafting Memorandum of Association (MoA)

A Memorandum of Association (MOA) of a limited company includes the objectives of a company. One can add as many objectives as one wants. However, it needs to be kept in mind that to start a business in banking, finances, school, or hospital, prior approval from the concerned authority is required. In addition to the objectives of a company, an MOA also includes the authorized capital of the company.

Drafting Article of Association (AOA)

Article of Association (AOA) is the constitution of the company. An AOA contains all the rules of how a limited company will run and who will be the Managing director, Chairman, and Director of the company. In addition, an AOA also includes how the company bank account will be operated, how the decision will be made among the shareholders, and what will be the minimum quorum for making a decision.

Bank account opening (for foreign nationals or entities)

At what stage one can open a bank account, will defer between foreign national / entity and Bangladeshi nationals? In the case of foreign nationals/entities, after getting the name clearance certificate, the signatory of the bank account will go to the bank and deliver the following documents to open a provisional bank account in the name of the company.

Documents required:

- Photocopy of name clearance certificate

- Draft AOA and MOA

- Photocopy of passport (application for foreign nationals)

- C1 Form

After receiving the above-mentioned documents, the bank will open a provisional account in the name of the company.

After opening the provisional bank account, a share money deposit will be sent from the country of the foreign shareholder to the provisional account. The money is required to be sent from the person or entity account of the shareholder. After receiving the payment, the bank in Bangladesh will issue an encashment certificate.

Registration to RJSC:

After receiving the encashment certificate, a few documents need to be submitted to the RJSC namely AOA, MOA, and encashment certificate along with all other necessary information. After receiving all the necessary documents and information, RJSC will generate an invoice to be paid to the recognized bank.

Required documents and information for company formation in Bangladesh

The documents and information required for company formation are as follows:

- Particulars of Directors i.e. name, parent’s name, passport number, email ID, mobile number

- Name of Managing Director

- Name of Chairman

- NID (if Bangladeshi national)

- TIN (if Bangladeshi national)

- Limit of paid-up capital

- Limit of authorized capital

- Photo of all shareholders (1 copy)

- Address of company

- Signatories of the bank account

Government cost for Company registration in Bangladesh:

It depends upon the authorized capital of the company. For instance, if the authorized capital is 50lakh, the government fee will be BDT 13570 or USD 160 along with 15% VAT. You can calculate your cost here

Incorporation certificate:

After receiving all the above-mentioned documents, RJSC will verify all the information given in the AOA and MOA and will also verify the encashment certificate with the bank. After being satisfied with all the information, the RJSC will issue an incorporation certificate in the name of the company.

Below is a sample Certificate of Incorporation

After completion of all the above procedures, your company will be registered and incorporated as a limited company in Bangladesh. if you want to know more about please click here.

Steps to be taken post Company registration Compliances

Company Tax Identification Number (TIN):

After receiving the incorporation certificate, an application needs to be made to the National Board of Revenue (NRB) for a tax identification number. Upon receiving the application, a tax certificate will be issued under the name of the company.

Company Trade license

To get a trade license an application needs to be made to the concerned city corporation. Along with the application, the following information needs to be submitted:

- Photocopy of AOA and MOA

- Photo of Managing Director or Chairman

- TIN of the company

- Rental agreement

- Nature of business

It usually takes 3 to 4 working days to get a trade license. to learn more about how to get a trade license in Bangladesh please click here.

Opening Bank accounts (for Bangladeshi nationals or entities):

To open a bank account under the name of the company, a Bangladeshi national needs to submit the incorporation certificate, AOA, MOA, TIN, and Board resolution to the bank. Thereafter, a bank account will be opened under the name of the company and the company can start transactions with the bank.

RJSC Return Filling:

Every limited company is required to file documents related to the management or operation of the entity to the RJSC in prescribed forms and schedules. This is called Return Filing. There are two types of return filing namely Annual Return Filing and Returns Filing for any change in an entity.

What is the Procedure for return filing?

- Returns need to be submitted by entities for filing at RJSC

- The filing fee needs to be paid by the entity to the RJSC counter and if applicable needs to pay the late filing fee as well.

- If the submission is incorrect or incomplete, RJSC will notify the remedial measures to the entity

Types of Annual Returns to be submitted

- Annual summary of share capital, list of shareholders and Directors (required to be filled within 21days of AGM)

- Balance Sheet (required to be filled within 30 days of AGM)

- Profit and Loss Account (required to be filled within 30 days of AGM)

- Form 23B Notice by Auditor (required to be filled within 30 days of receiving appointment information from the company)

Types of Returns for change to be submitted

- Notice for division, sub-division, consolidation, or conversation into the stock of shares to be filled in Form III within 15 days of consolidation and division, etc.

- Notice of increased share capital/member to be filled in Form IV within 15 days of increase of share capital or member

- Notice of any change in the Registered Office to be filled in Form VI within 28days of change

- Special Resolution or Extraordinary Resolution to be filled in Form VIII within 15 days of the meeting

- Director’s consent to act to be filled in Form IX within 30 days of appointment

- Particulars of the Directors, Manager, and Managing Agents and any change therein to be filled in Form XII within 14 days of appointment or any change

- Return of allotment to be filled in Form XV within 60days of allotment

- Particulars of mortgages or charges to be filled in Form XVIII within 21 days of the creation of mortgages

- Instrument of transfer of shares to be filled in Form 117

Value Added Tax (VAT) Certificate:

To carry out normal business operations in Bangladesh after the formation of a private limited company, the company must have a unique Business Identification Number (BIN). Normal business operation includes import and export, carrying out banking activities, participation in the tender, etc. Therefore, to get a Business Identification Number, companies are required to have a VAT registration certificate. VAT is regulated by the Customs, VAT, and Excise Department of the National Board of Revenue (NBR). Applying for VAT registration is free.

Required documents for VAT

- TIN Certificate

- Trade License

- Import/export Registration certificate

- Passport sized photos

- Deed of Agreement

- Bank solvency certificate

- BOI registration

- Memorandum and Articles of Association

Every private limited company needs to pay the VAT on the 15th (fifteen) of every consecutive month.

Legal Advice regarding setting up a private limited company in Bangladesh by CLP

The Barristers, Advocates, and lawyers at CLP in Gulshan, Dhaka, Bangladesh are highly experienced in assisting clients through the entire formation of a Private Limited company process and legal provisions relating to setting up a private limited company in Bangladesh.

For any queries or legal assistance, please reach us at

- -E-mail: info@counselslaw.com,

- Phone: +8801700920980. , +8801947470606.

- Address: House 39, Road 126 (3rd Floor) Islam Mansion, Gulshan 1, Dhaka.

My brother suggested I might like this web site.

He was totally right. This post truly made my day.

You can not imagine simply how much time I had

spent for this information! Thanks!

Thanks for your comment.

Thanks for sharing your thoughts about Law firm in Dhaka | counselslaw.com (CLP).

Regards

Thanks for your comment.

Quality posts is the main to invite the people to pay a quick

visit the web site, that’s what this site is

providing.

Hurrah, that’s what I was seeking for, what a stuff!

existing here at this blog, thanks admin of this site.

Thank you